The client is a fast-growing consumer finance provider in the United States with a wide branch network and a strong reputation for flexible lending products. Known for delivering quick access to funds and transparent customer service, the company sought to strengthen its digital backbone. As part of its modernization journey, it aimed to re-engineer its data architecture to achieve 360-degree visibility across loan applications, disbursements, and customer insights, enabling faster and more informed decision-making.

Fragmented reporting and lack of real-time visibility

The client operated their loan origination and servicing on an online platform backed by MongoDB, a NoSQL database. While loan applications were processed by bank staff, there was no centralized, real-time view of operations. Instead, aggregated data was delivered through manual Excel-based reports refreshed weekly or monthly, with each update taking hours and prone to errors due to siloed workflows and undefined processes.

Delayed insights and limited granularity in reports

Leadership struggled to access timely insights on application volumes, approvals, rejections, or the reasons behind loan decisions. Data was often outdated by 30 to 60 days and lacked the granularity needed for daily or branch-level analysis. Tracking loan disbursements across 500 branches was inconsistent, compliance monitoring was unclear, and management faced long delays in performance visibility—while customer demand for faster credit decisions continued to rise.

Performance limits of MongoDB for analysis

Although effective for storing semi-structured JSON data, MongoDB was poorly suited for real-time slicing, indexing, and analytics. Dashboard pages were slow to refresh, report generation was delayed, and the insight cycle lagged behind market speed, risking lost opportunities in customer satisfaction, revenue growth, and competitive positioning.

The business urgently required a modern, unified data architecture capable of integrating multiple data sources, automating reporting, and delivering insights at the pace of lending decisions.

Migrated data to SQL Server with ZIO for performance and structure

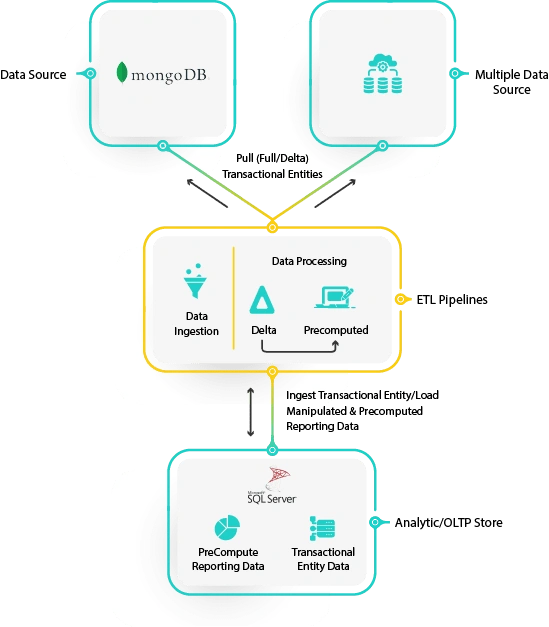

First, we addressed key limitations of MongoDB by migrating data into SQL Server using ZIO, our proprietary enterprise data hub. This transformation converted hierarchical JSON data into a structured row-and-column format, enabling indexing, partitioning, and significantly faster query performance. The result was a centralized, scalable reporting foundation optimized for analytics workloads.

Deployed ETL pipelines to automate data ingestion and summarization

Leveraging ZIO, we deployed two robust ETL pipelines:

This ensured near real-time data availability, with updates available every hour instead of once in weeks.

Transformed business data into actionable visual insights with Power BI

We integrated the SQL data layer with Power BI, creating 12 interactive executive dashboards to track loan applications, approvals, rejections, disbursements, EMI collections, and resource utilization. The dashboards offered drill-down capabilities for branch-level tracking, compliance monitoring, and performance benchmarking, transforming decision-making speed and accuracy.

Unified historical and incremental data seamlessly

Our team migrated historical loan and application data into the new SQL repository while enabling automated incremental updates. This not only preserved business continuity but also created reliable archives for forecasting and compliance audits.

Start unlocking value today with quick, practical wins that scale into lasting impact.

Thank you for subscribing to our newsletter. You will receive the next edition ! If you have any further questions, please reach out to sales@zucisystems.com