Minimized non-performing assets using machine learning for a century-year-old bank in Asia

01

Machine Learning Model Development Case Study

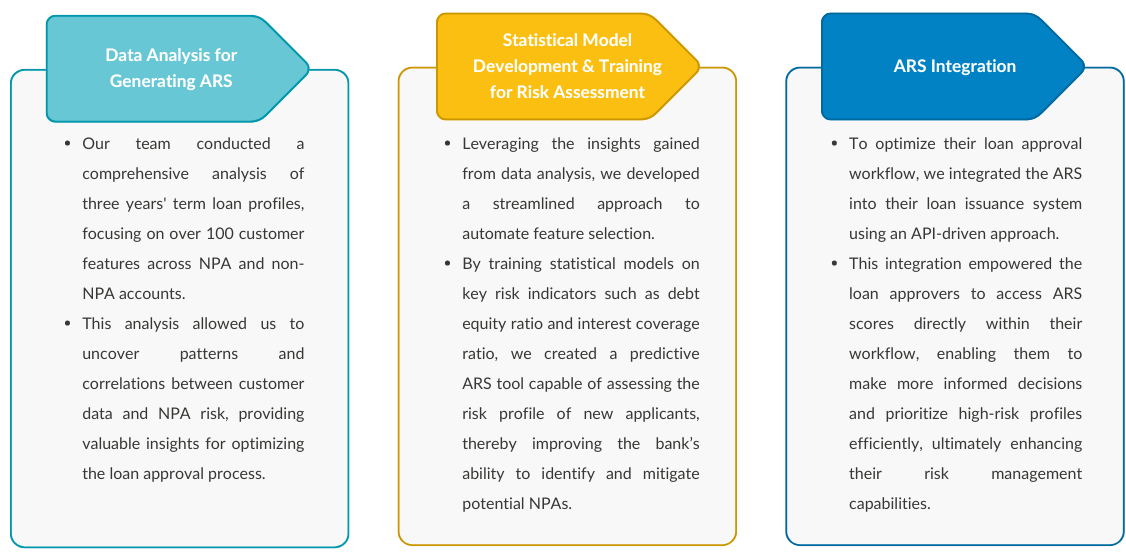

Our banking client aimed to reduce its non-performing assets in the term insurance portfolio by constructing an ML model capable of predicting NPA profiles during the loan disbursement stage. Their primary goal was to equip the loan disbursement manager with a mechanism to identify the profiles who are prone to becoming NPAs.

02

Meet Our Customer

Dating back to the 1940s, our customer is one of the oldest banks in South Asia, offering a wide range of banking products and services catering to MSMEs, corporates, and individuals.

03

Problem Statement

- To implement measures to effectively mitigate the risk of NPAs within the term insurance portfolio for enhanced portfolio performance and sustained profitability.

- To establish a robust Acquisition Risk Score (ARS) system for evaluating potential customers’ creditworthiness and likelihood of default, enabling loan approvers to make informed decisions and minimize NPA exposure

- To implement a seamless integration of the ARS into the bank’s loan issuance system to perform comprehensive risk assessment data during the loan approval process.

04

Zuci’s Approach to Reduce the NPA

05

Tech Stack

06

Key Achievements

Achieved a

Reduced the loan approval time by

07