Reading Time : 1 Mins

Role of Generative AI in Banking and Financial Institutions

A web-analytics nerd, speaker - here delving into (Big)-data.

Be it web 2.0 or mobile applications, enterprises have been adopting innovative technologies on their path toward digital transformation. Banking and financial institutions have pioneered experimenting, failing, and adapting quickly to innovative technologies, leading to early adopters of generative AI technology. While chatgpt took the world by storm in 2023, leading financial institutions such as Goldman Sachs & Co., Morgan Stanley, JPMorgan Chase & Co., and Wells Fargo & Co. were already on the verge of adopting Generative AI in banking their day-to-day operations, leading to improved operational efficiency.

Guess what?

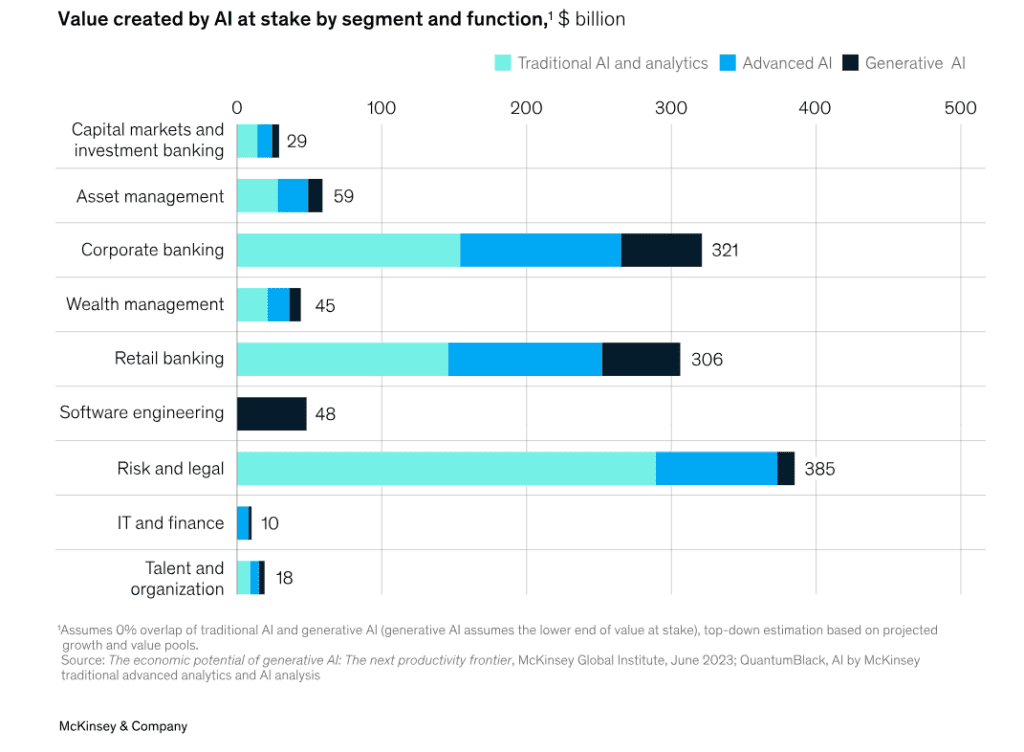

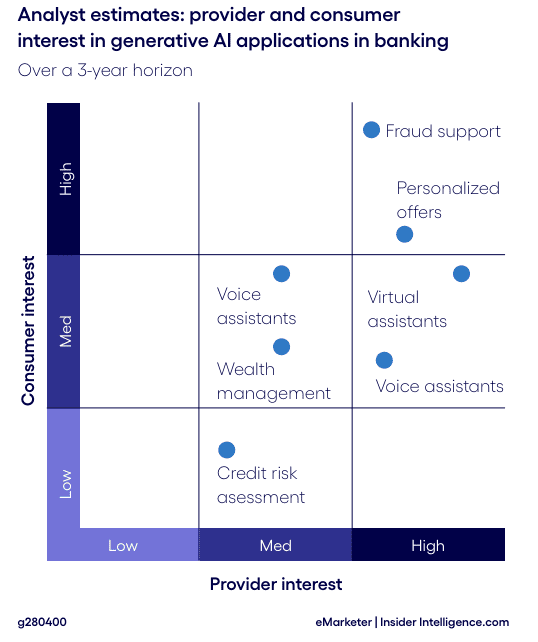

McKinsey’s report states that generative AI can potentially deliver significant new value to banks—between $200 and $340 billion in areas such as capital markets, asset management, wealth management, customer service, and risk & legal.

It’s imperative to explore how generative AI operates to understand the advantages of generative AI in banking.

Generative AI:

- creates human-level content such as images, text, code, and video.

- helps in human-like decision-making and adds contextual awareness to enterprise and finance workflows.

- is fueled by foundation models, which run on deep-learning algorithms

Read more: Generative AI services

Generative AI propels the financial services shift to BaaS.

With the help of generative AI technology, financial institutions are speeding up their search for the right AI vendor to adopt the Banking as a Service (BaaS) model for an early shift from ideation and planning to implementation.

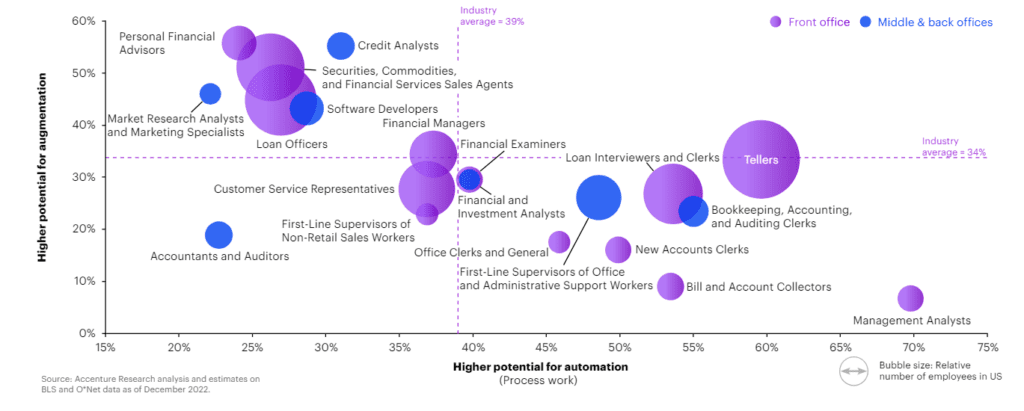

Though generative AI is gaining substantial traction in the financial sector for personalized customer services, its applications extend to anti-money laundering, compliance, underwriting, and KYC processes, covering critical areas of banks’ front-office, middle-office, and back-office operations.

Generative AI in Banking and Finance Sector: Use Cases

Generative AI in Banking and Finance Sector: Use Cases

Use Case 1 – Fraud Detection

Technology: Deep Learning

Challenges:

- Fraudulent activities continue to evolve, making it difficult for existing systems to identify and detect effectively.

- Identifying patterns with manual activities or traditional AI algorithms can be tedious, considering the vast volumes of transactional data.

- Traditional systems sometimes flag legitimate transactions as fraudulent, leading to increased operational costs and customer dissatisfaction.

Generative AI Solution: Deep learning algorithms analyze vast volumes of data and identify tedious patterns indicative of fraudulent behavior. With the help of neural networks, deep learning models continually learn from new data, enhancing their ability to detect emerging fraudulent activities. In addition, deep learning techniques can significantly reduce false positives by distinguishing between fraudulent and legitimate transactions, improving customer satisfaction.

Use Case 2 – Customer Service

Technology: Natural Language Processing

Challenges:

- Banks face challenges in providing personalized customer experiences because data is stored across disparate systems.

- Due to the growing nature of customer data, human agents need help promptly providing personalized services to customers.

- Banks and other NBFCs must adhere to customer data privacy regulations with respect to using specific customer data for tailored services.

Generative AI Solution: Natural language processing algorithms seamlessly analyze large volumes of customer data to create cohesive customer profiles. With a 360-degree understanding of customer behaviors and preferences from textual data, NLP removes all roadblocks, enabling banks and NBFCs to offer personalized financial advice, product recommendations, and a seamless customer service experience through virtual assistants and activation AI-powered kiosks. Besides, NLP technology ensures that customized services are delivered seamlessly while maintaining data privacy and compliance with regulatory requirements.

Read More: Generative AI vs. Activation AI

Use Case 3 – Compliance

Technology: Reinforcement Learning

Challenges:

- Financial institutions experience a complex regulatory landscape, needing frequent monitoring and sticking to regulatory changes.

- Compliance tasks, including monitoring transactions and conducting due diligence, are time-consuming and labor-intensive.

- Banks and NBFCs failing to comply with regulatory standards can face challenges in reputational damage and financial penalties.

Generative AI Solution: Compliance tasks can be automated using reinforcement learning algorithms by training the algorithm with regulatory guidelines and historical data to make swift decisions. These models can optimize the regulatory process by leveraging penalties and rewards, reducing non-compliance risk, and improving efficiency.

In addition, reinforcement learning techniques can help banks and NBFCs learn and adapt to changing regulatory requirements, ensuring they remain compliant in the evolving regulatory environment.

Use Case 4 – 24/7 Customer Support Chatbots

Technology: Natural Language Processing

Challenges:

- Customers might ask complex financial queries that traditional chatbots need help comprehending and responding to users.

- Traditional chatbots might not recognize customers’ emotional cues, impacting the quality of customer service.

Generative AI Solution: Natural language processing algorithms power chatbots, which swiftly comprehend customer queries and respond to complex queries in a way that is similar to human output. With sentiment analysis, NLP chatbots help banks offer personalized 24/7 customer support experiences. NLP chatbots also learn from previous interactions and improve their responses and the quality of customer service over time.

Use Case 5 – Automating KYC Process

Technology: Computer Vision

Challenges:

- Traditional processes rely on manual document verification, leading to inefficiencies and delays.

- Inconsistencies and human errors in document verification processes can compromise KYC accuracy and leave NBFCs vulnerable to fraud.

- As customer bases grow, the KYC process becomes resource-intensive and time-consuming, increasing operational costs.

Generative AI Solution: Computer vision algorithms act as a human eye and help extract and analyze identity documents such as driver’s licenses and passports.

With optical character recognition (OCR) and image recognition techniques, computer vision systems can verify the authenticity of documents and extract the most relevant information for KYC checks. Most banks and financial institutions face challenges in flagging potential fraud attempts during the primary KYC process, and computer vision algorithms can help detect anomalies and inconsistencies in documents to prevent fraudulent KYC activities.

Use Case 6 – Trend Analysis for Market and Investment Strategies

Technology: Deep Learning

Challenges:

- Financial institutions generate vast amounts of unstructured data from customer service calls and voice kiosk sources, making extracting relevant trends and meaningful insights tedious.

- Traditional trend analysis methods can’t catch up with the speed of rapidly evolving market conditions and investor sentiments.

Generative AI Solution: Deep learning algorithms can inspect structured and unstructured data to identify trends and patterns accurately. With neural networks, these algorithms can detect correlations and signals that existing methods may overlook, enabling financial institutions to make informed investment decisions. This technology can improve its forecasting accuracy over time through model refinement, providing investors with valuable insights.

Whether traditional AI or generative AI, choosing the appropriate technology varies from one challenge to another. At Zuci Systems, we inspect your data infrastructure, identify unactivated data, and help solve business problems with AI technologies. Do you want to consult with our Chief Technology Officer?

Related Posts