Reading Time : 0 Mins

Digital Lending – Are You Ready To Transform?

I write about fintech, data, and everything around it

“Accurate credit decisions, vastly improve the lending experience of a customer and lender, 45 to 60 percent lower costs, and a more secure risk profile. But how do you plan to get there?”

In recent times, the average “time to decision” for small business loans and corporate lending is between three and five weeks. The average “time to cash” is nearly three months. The life span of a debit or credit loan seems antiquated and unacceptable as the three weeks is adequately vast and if I had this time I would rather find an alternative option. I suppose you would do the same.

But with the Credit Default Prediction, “time to yes” is down to a few seconds, and “time to cash” to lesser than an hour. And, this is the profound priority of financial lending institutions around the world: the digital transformation of end-to-end credit journeys, including the customer experience and supporting credit processes. Credit is at the heart of most customer relationships and digitizing it offers significant advantages to lending institutions and customers alike.

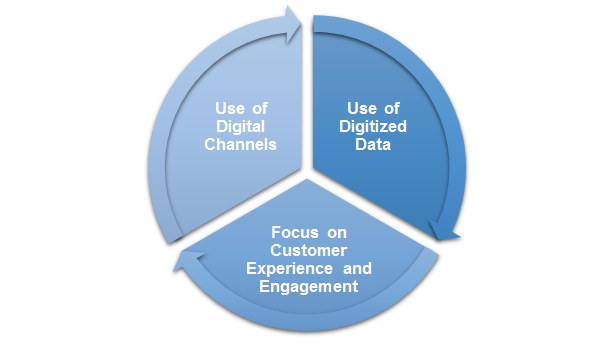

In this article, we will look at the three core lifeline principles that every financial institution should be aware of before deep diving to build digital-lending capabilities and transform their institutions.

1. Use of Digital Channels

Digital lending should leverage digital channels such as smartphone apps and USSD (Unstructured Supplementary Service Data) menus to reach new and existing potential customers where ever they are: at home, at work or on-the-go. Digital Lending should be Omnichannel. A multichannel approach to sales that seeks to provide customers with a seamless shopping experience, whether they’re shopping online from a desktop or mobile device, by telephone, or in a brick-and-mortar store. So that they can apply for credit, receive loan disbursements, obtain information on their accounts, and make payments remotely. An effective digital channel allows customers to engage with the product or service wherever and whenever it is convenient for them. Such channels also support the collection of digital customer data by the FSP (Full Service Provider is an application service provider (ASP) that offers a wide range of Web-based information technology services).

2. Use of Digitized Data

Instead of face-to-face, time-intensive evaluations, digital lending depends on digitized data to evaluate clients. And, “Data is the Foundation for Artificial Intelligence.”

A variety of data sources, such as bank statements, bill payment histories, e-commerce transactions, call data records, credit bureau information and a lot more compiled in a Data bank, is fed into machine learning algorithms and analyzed to predict willingness and capacity to repay, cross-sell/ upsell Next best product analysis. Customer data is also used to build engagement strategy and improve the customer experience – for example, by offering personalized communications or specially-designed product offerings such as targeted promotions based on customer behavior or Customer 360. Over time, once digital processes are in place, the credit decision would be made in a few seconds and loan dispersal in less than a few minutes.

3. Focus on Customer Experience and Engagement

Digital lending from the customer perspective focuses on how the customer experiences the whole customer journey of buying a digital product. And, financial institutions, on the other hand, are keener on Profitability Mapping (or) Customer Attrition Mapping to bring in best sales practices and query handling. Digital lending or lenders use digital channels and data to offer clients convenient access, quicker approval, personalized communication, and responsible products and pricing options along the customer journey.

In addition to the three core components of digital lending described above, we further characterized four key pillars of digital lending. Click here, to know how to structure your digital lending journey.

Related Posts