Reading Time : 1 Mins

4 Key Pillars For Financial Services To Boost Digital Lending

An INFJ personality wielding brevity in speech and writing.

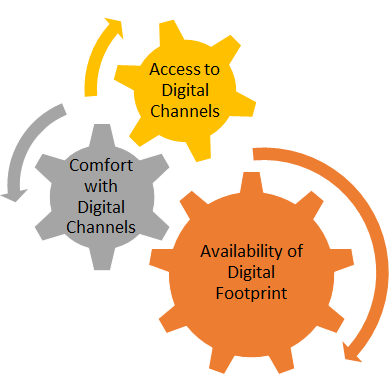

There’s an old marketing adage that says, “You’re not selling a drill. You’re selling a hole.” And, applying the same for financial institutions we might revise and say, “You’re financing a hole.” Digital Lending is all about finding an effective and efficient ‘tech and touch’ channel strategy that integrates both digital and human features based on three aspects of the customer segment: the customer’s access to digital channels, comfort and willingness to use digital financial services (DFS), and whether they have a ‘digital footprint’ to provide digitized data for acquisition and underwriting.

We further break down the four key pillars of digital lending which point out how to drive your digital journey to digital lending. Adding, this blog is a continuation of the three core components of digital lending.

1. Digital Readiness Is Not Digital Lending

Even though “Digital Readiness” is an important step of Digital Lending, it’s still a static requirement. Let me ask you a question, “What makes a lender digital?” Most of you would answer, digital channels, tools, and products – including digital field applications (DFAs) and cloud-based core banking systems that FSP’s can deploy, many of which help streamline operations, reduce costs, and increase profits.”

Although their implementation is an important step in building digital readiness still digital readiness is not sufficient on its own to constitute digital lending. What’s required instead is a comprehensive organizational transformation to the point that an FSP is using these tools to create an integrated digital product that offers an improved customer experience. From the customer perspective, a well-designed digital product offers quicker access to credit or (Credit Default Prediction), reduced physical documentation, convenient channels for disbursement and repayment (i.e. An Omnichannel approach), and a more personalized and customized interaction with the FSP.

2. Digital Lending Ecosystem

The digital lending ecosystem is complex and evolving. Digital lending models are rugged when it comes down to distinct market structures, regulatory environments, and customer needs. A very few offer end-to-end digital solutions, while others focus on a specific component of the lending process and leverage partnerships to supplement their models.

As per a recent report by BCG, about 5 million loans have already been disbursed to individual borrowers and MSMEs through new-age digital lending marketplaces that have saved numerous annuities from falling into a loan trap by local lenders.

The tradition loan lifecycle has to break through to a simpler and easier route through the ‘3-1-0′ model of lending- three minutes to decide, one minute to transfer the money and zero human touch. The new-age digital lending platforms are disrupting the lending industry globally. Yet, this model still needs validation and support from regulators and government initiatives to work on a large scale.

3. Any Lending Product can be “DIGITAL”

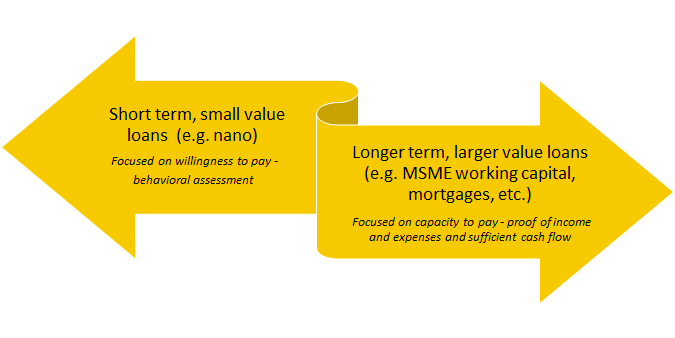

As a financial institution there are a lot of obligation to keep relevant records (i.e. “business transactions records”), draft clear customer acceptance policies and procedures, proper identification (i.e. “KYC”), establish a systemic procedure for identifying new customers and should not establish a relationship until the identity of a new customer is satisfactorily verified and documented, and enforce policies and reporting any suspicious activity, etc.

Although all this is important to be made digital to derive loan products of all sizes, up to large SME loans or even mortgages, providing that willingness and capacity to pay assessed credibly with data from digital sources and delivering different types of loan products digitally is what makes a financial institution “Digital”.

4. Re-engage passive customer with digital lending

A reasonable percentage of customer base still are unengaged with the new adaptation of technology due to lack of resources or willingness to adapt to new-age tech. We will still find customer’s discomfort with the digital channels, poor connectivity or prefer face-to-face interactions with loan officers.

Despite these challenges, strong customer segmentation and customer understanding together with a differentiated approach can ensure that digital lending can reach all customers. The key is to offer the right product to the right customer in the right way. And, this can be attained with a consideration based on the three aspects of customer segmentation.

Digitized data is a pre-requisite for digital lending. Click here, to know how to structure your Digital Footprint.

Related Posts