Reading Time : 1 Mins

How Is Data Analytics Used In Finance And Banking Sector?

I write about fintech, data, and everything around it

This article discusses how banks and financial institutions use data analytics to overcome issues and challenges they face today, such as low revenues, security threats, and heavy workloads in various areas of demand, supply, and risk management.

Data analytics has become the big buzzword over the past decade, with many organizations incorporating some form of data science into their operations. And banks are no exception.

The increasing interest in the use of data analytics in the banking industry is due to the increased changes that have been happening in this sector. Changes in technology, changes in people’s expectations, and changes in market structure and behavior.

The advent and application of data analytics have helped the banking industry optimize processes and streamline its operations, thus improving efficiency and competitiveness. Many banks are working on improving their data analytics, mainly to give them an edge against competition or to predict emerging trends that can affect their businesses. This blog post explores why banks need data analytics and how banks are using data analytics for various processes. Along with a case study on how Zuci Systems helped a 100-year-old bank with data engineering and analytics.

If you are a decision-maker in the finance and banking sector and want to get an edge with better business decisions, this blog is for you.

Why do banks need data analytics?

Most of us have a trustworthy relationship with our banks and financial institutions. Our relationships with banks are built on trust, loyalty, and personal service. However, the increasing sophistication of banking services and products has fueled the need for effective decision-making tools to enable better decisions from data insights.

Viewing documents and numbers alone is not something that can influence your businesses anymore. The banking sector needs to utilize its data for analysis and better decision-making.

When you analyze data, you will be able to determine how you can maximize your profits and improve business relationships and customer service. That’s where you need data analytics. Evaluating your documents and transactional data will help you create a better picture of your business and its operations.

How are banks using data analytics?

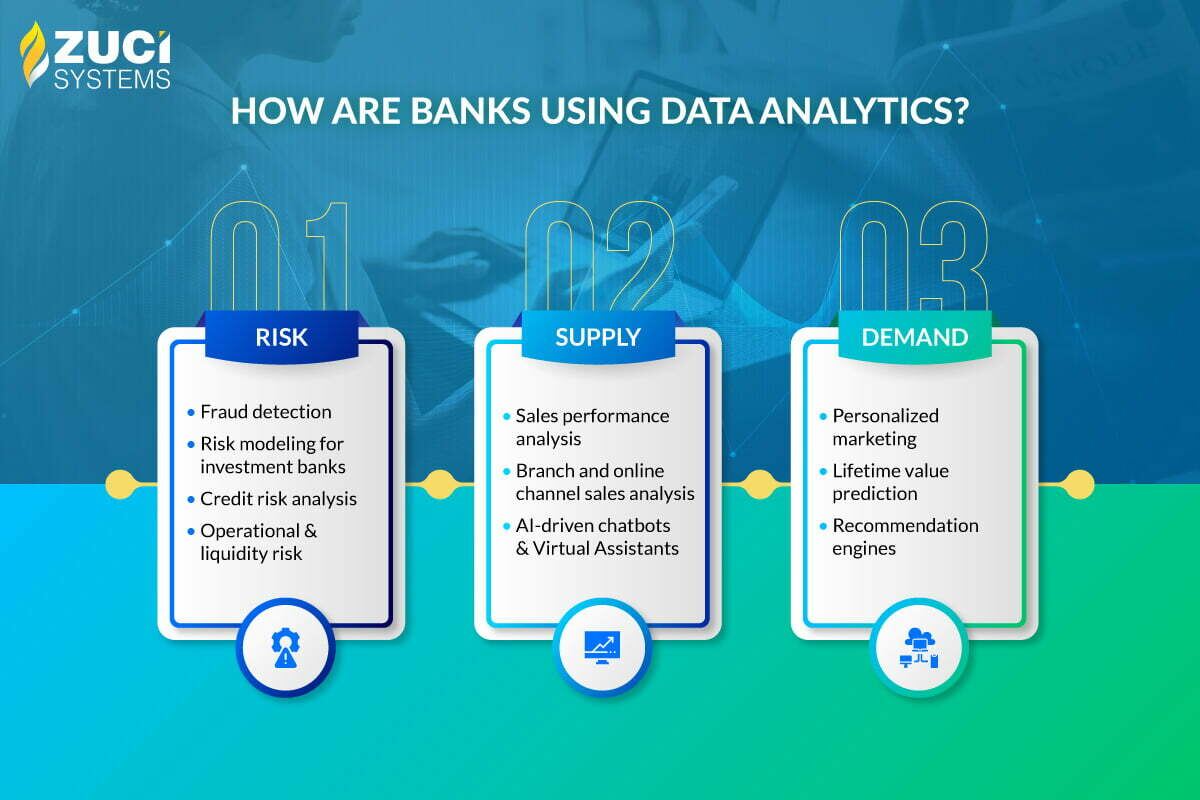

Data analytics in the finance and banking sector is mainly used in demand, supply, and risk management.

While the traditional approach to analytics in finance and banking was to generate reports and dashboards, today’s banks and financial institutions are using data analytics in a more purposeful way.

Banks want to know whether their customers are paying on time. They want to know how their customers use their credit cards. And they want to know whether customers are using certain products with the bank. Also, to keep track of security aspects with a predictive approach than a reactive approach.

Though data analytics is becoming common for banks and financial institutions, it is still fairly new. It’s not yet a standard practice, and it is not always used in the same way by every bank and financial institution.

For example, many people think that credit scores are static, unchanging numbers, but they’re actually dynamic, constantly evolving as new information comes in or as old information is updated.

Let’s look at some examples of data analytics used in the banking sector in demand, supply, and risk management.

Examples of how banks and financial institutions use data analytics to manage risk.

a. Fraud detection

While fraud reduction is a common goal for banks and financial institutions, analytics can be used to manage risk instead of simply detecting fraud.

Analytics can be used to identify and rate individual customers who are at risk of fraud and then apply different levels of monitoring and verification to those accounts. Analyzing the risk of the accounts allows banks and financial institutions to know what to prioritize in their fraud detection efforts.

b. Risk modeling for investment banks

Risk modeling is the process of simulating how a portfolio of assets (stocks, bonds, futures, options, etc.) or a single asset (such as an interest rate) moves in response to different scenarios. When risk modeling is done correctly and consistently across all assets, you can reduce your portfolio’s overall risk and improve its performance.

For example, if a bank wants to do an investment banking transaction, they would need to consider the following:

- What are the expected returns?

- What are the risks?

- What is their probability?

- How important is this transaction compared to other alternatives?

Risk models are used in many fields with financial institutions to describe how risky things are, what’s likely to happen, and how much it will cost to mitigate risk. We will look at more such models below.

c. Credit risk analysis

Banks and financial institutions use analytics to manage the risk associated with the loans they make. This is done by monitoring data they collect on individual customers. This data can include, but is not limited to:

- Customer credit score

- Credit card utilization (how much you owe)

- Amounts owed on different credit cards (total debt)

- Amounts owed on different types of credit (total debt/total credit)

Credit risk analysis is the analysis of historical data to understand a borrower’s creditworthiness or to assess the risk involved in the granting of a loan. The results of the analysis help banks and financial institutions evaluate their risks and those of their customers.

d. Operational & liquidity risk

The term “operational risk” is used to describe the potential for loss due to actions taken by the business. Operational risk encompasses risks that are specific to an individual financial institution.

In contrast, liquidity risk is more macro in nature, including issues such as interest rate fluctuations, changes in foreign exchange rates, and changes in the value of other financial instruments, such as bonds.

The operational risks are possible losses that result directly from risks associated with day-to-day operations of the institution, i.e., fraud, theft, computer security breaches, or error in judgment or incompetence at an executive level.

For example, a bank has a limited number of teller machines available. If the bank doesn’t have enough tellers on duty at all times, it can increase its operational risk by having too few staff to serve customers properly.

Whereas, Liquidity risk is the threat that a bank’s assets will fall below the amount required to meet its liabilities.

Liquidity risk occurs when the availability of funds is insufficient; it can be caused by bad loans (which may not ever be repaid) or lower-than-expected cash flows (such as lower-income/deposits). The latter is particularly risky for banks because their funding sources are mainly deposits, which are paid out as a net of interest.

A liquidity problem can quickly force the bank to tap the government for loan guarantees; this is an especially costly and risky step if yields on government bonds and other securities drop.

To manage these risks, banks use data analysis tools to detect situations where there is a higher probability of defaulting on loans, which allows them to take early action before things get out of hand.

Examples of how banks and financial institutions use analytics to manage supply (ex: dealing with cash flow).

a. Sales performance analysis

When a customer walks through the doors, there’s a wide range of things that can happen. Someone could walk in and tell you she has $20,000 in cash she wants to deposit to open a checking account. Or maybe you’re meeting with a banker who is looking for a particular investment. Whatever the case, when you’re selling something, there’s one thing that will always happen: You’ll end up with some amount of money.

That much is obvious, but what isn’t obvious is how much money — and how much impact your performance analysis has on the amount of money you get and how it impacts your business, and whether you can keep growing. The answer to that question depends on several factors: How many customers come in? What do they buy? And which ones do enough business to make a difference?

Performance analysis is just another way you measure performance over time — whether it’s sales performance or cash flow analysis — and it enables you to track and measure results over multiple periods so you can determine what’s happening at each stage of your business.

b. Branch and online channel sales analysis

In a way, banks and financial institutions treat their branches and online channel sales as a supply chain that they need to manage. Banks have to take into account how much cash they have, what’s coming in through the channel, and what’s going out to the channel.

When you’re doing some data analysis and want to know the difference between your branch and online channels, you might be surprised at how much it affects your business.

In a nutshell, branch sales are more profitable per capita, but they account for a smaller percentage of total sales. Online transactions make up a larger percentage of total revenue per customer, but they don’t generate as much profit per sale. In most cases, the key is to focus on the bigger picture. That is where data analytics comes into the picture.

c. AI-driven chatbots & Virtual Assistants

AI-driven chatbots and virtual assistants can help you reduce the amount of time you or your employees spend on your daily tasks.

These chatbots and virtual assistants can be used in many situations:

- To assist in customer service and knowledge management.

- To replace manual processes such as emailing or calling rooms.

- To increase customer engagement through personalized interactions.

These are just a few examples of how banks and financial institutions use AI to better serve their customers. There are many others on how AI is being used by financial institutions, including but not limited to: obtaining knowledge about their clients’ habits so they can offer them more personalized solutions; providing more meaningful advice on investments; offering advice based on what clients have already invested in; and improving customer relationships through effective marketing campaigns.

Examples of how banks and financial institutions use analytics for managing the demand side of the equation.

a. Personalized marketing

For financial institutions, the main challenge is managing the demand side of the equation. By focusing on their most profitable customers, banks can secure profits from a system that gives them access to a customer they may not have had otherwise. In order for banks to achieve this, they must know who their most profitable customers are. This is where analytics comes into play.

Today, banks will use a variety of data sources to determine who they should target with marketing messages and offers.

b. Lifetime value prediction

Customer lifetime value (CLV) is a term used to describe the amount of money a customer is likely to spend with a bank over the course of their lifetime. This is different from the traditional view on brand value, which refers to how much a customer is willing to pay for a product or service.

In order for banks and financial institutions to optimize their business models, they need to consider both customer value measures. Traditional analytics tend to focus on the former while ignoring the latter, which can significantly impact revenue. And it’s not surprising that CLV prediction has become one of the most important tools in understanding customers’ needs and wants.

c. Recommendation engines

Banks and financial institutions are not only looking at how their current customers use the products they offer; they are also focused on how to attract new customers.

When it comes to managing the demand side of the equation, banks and financial institutions are using analytics to develop predictive models that take into account individual customer characteristics. Like a credit score, income level, etc., and things like location, which can be used to evaluate consumer behavior patterns. The models provide insight into how different segments of the population behave, which allows for more personalization of products and services.

The key here is that all these actions are done without disrupting your customers’ experience with your brand. So instead of just thinking about how to get people to buy from you, why not think about how to get people to stay loyal too?

A Case Study: How City Union Bank Used Data Science

City Union Bank is one of the oldest banks in India with a history of over 100 years, offering a wide range of banking services, deposits, loans, saving/current accounts, wanted an intelligent technology solution to transform the current underwriting approach for their gold loans.

The bank’s objective was to reduce the dependency on manual underwriting of gold loans and implement a scientific approach to improve risk assessment accuracy with deeper insights for their existing and new potential borrowers.

Check out the below video, where our client, Padmanaban T A, Head of Digital Banking at City Union Bank, explains how Zuci Systems helped reduce the dependency on manual underwriting of gold loans and implemented a scientific approach to improve risk assessment accuracy with deeper insights for their existing and new potential borrowers.

Final Thoughts

Data analytics is now a key component for the successful running of financial institutions. It consolidates all the data and reports into a small amount of data. Once you have all your data, you can easily draw conclusions from it.

The question is not so much about why your business should use data analytics, but more about how to navigate through the options and choose what is right for you.

Start building a data-driven organization today, so you can better keep up with customer demands.

Zuci’s data science and analytics services help reveal trends and metrics lost from your mass of information for you to make better business decisions. Schedule a 30-minute call with our data engineers to identify and fix your data problems and become a data-driven financial institution. Sign-up and get your customized roadmap for Free.

Related Posts

Related Posts