Reading Time : 1 Mins

How Credit Unions Can Use Transactional Data For Growth?

I write about fintech, data, and everything around it

As credit unions across the country continue to evolve into next-generation financial cooperatives, they are increasingly turning to advanced transactional data strategies as a competitive differentiator. Read on for expert tips that can help you determine how to leverage your transactional data to create member value.

In today’s credit union world, transactional data is taken for granted. As a credit union, you simply don’t view the data moving through your systems as useful for much more than compliance and reporting. But that’s about to change. Why?

Because transactional data—information about every financial transaction—offers endless untapped opportunities for growth and value creation.

Transactional data is not just about transactions. It’s about each member as an individual with unique interactions, concerns and interests, which are all recorded and analyzed to best solve their problems and meet their needs. Whether you’re talking about loans, investments, bill payments, check cashing, etc., your credit union will have a whole lot of transactions. And this data can be used in a variety of powerful ways that members will start to notice, even without them knowing what’s happening behind the scenes because the results speak for themselves.

But surprisingly a recent survey that we conducted among the credit union professionals indicates that transactional data is an underused resource in credit unions. Most CU don’t know how much transactional data they have or how they can use it more effectively to gain more members, grow faster and increase efficiency.

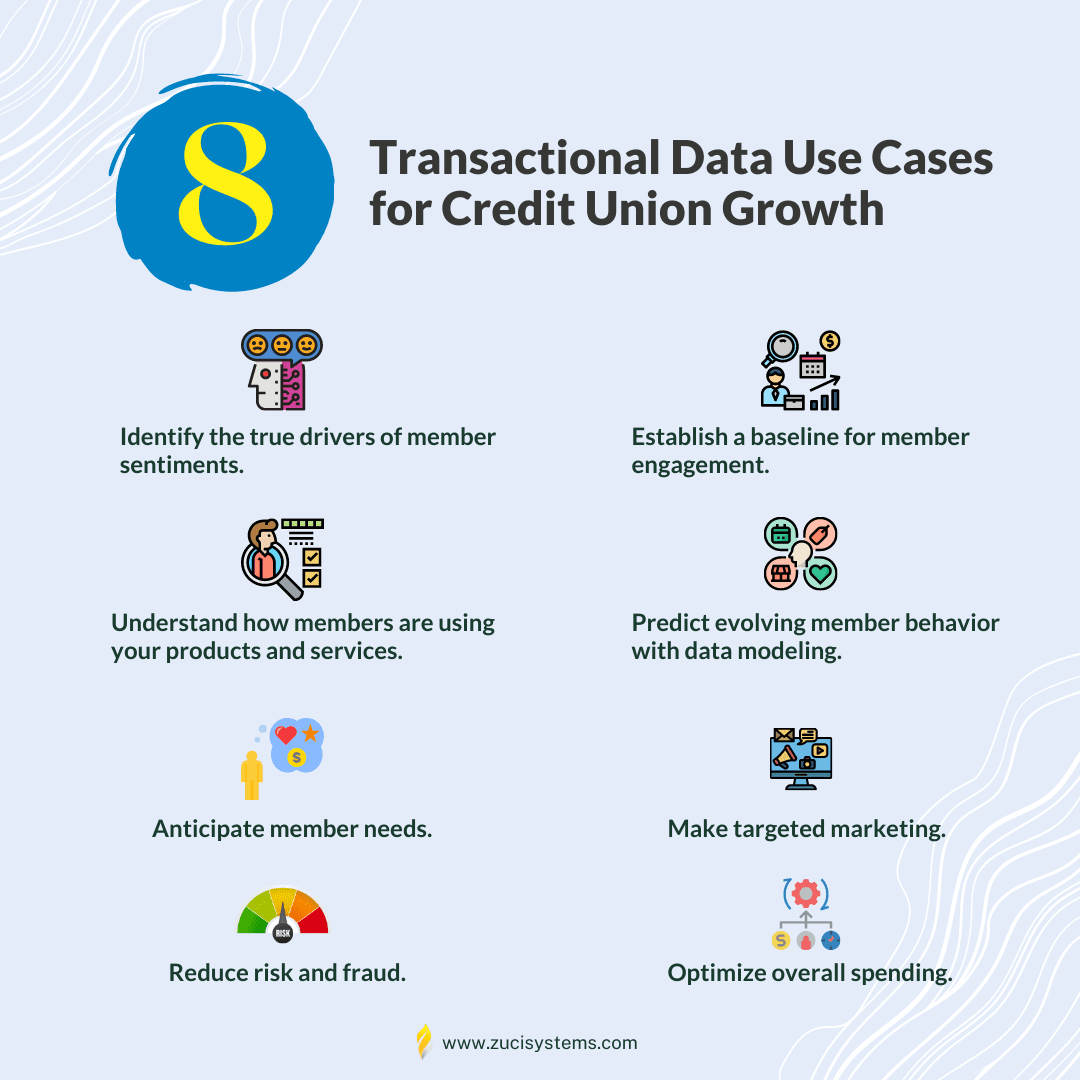

If you are one of them and want to know “How can you start using transactional data for your CU growth?” Here are some of the most popular use cases where you can leverage transactional data and improve products and services, as well as enhanced member experiences that foster stronger, more trusted relationships.

Transactional Data Use Cases for Credit Union Growth

Credit unions have long been known for their ability to build relationships with members and provide a superior customer experience, which has helped to drive market share in recent years. In today’s world of big data, however, cultivating these relationships becomes more challenging, as there are often so many different ways to interact with your members — online or offline — and various tools and channels to use when doing so.

There are also many ways to analyze your members’ behavior and preferences across all these different channels and touchpoints, but how can you ensure that you’re making the most of them? The answer lies in leveraging transactional data.

But what exactly is transactional data? It’s simply the details of a purchase made by a consumer — where they shopped, what they bought, and how much they spent. For example, if I use my credit card at Starbucks, the data stream shows that I paid $5 at Starbucks in Chicago on Feb. 14 at 2:02 p.m.

The key difference between transactional data and other types of customer data is its timeliness. Because consumers make purchases every day, this information can be used to create very timely marketing campaigns that will be seen by your members as relevant to their lives.

Here are just some of the ways Credit Unions can use Transactional Data to Drive Growth:

1. Identify the true drivers of member sentiments

Credit unions have a long history of member focus, which allows them the opportunity to build trust and loyalty. But when so many competitors are vying for members’ business, credit unions need to ensure they can deliver the services that members want and value.

A key way to do this is through sentiment analysis of transactional data, which allows credit unions to identify what truly drives their members’ sentiments and reactions. This helps create a more meaningful interaction between members and their credit union — and in turn, increases member satisfaction, which is a huge driver for growth.

2. Understand how members are using your products and services

Your members are actively engaging with your products and services, which means you have a wealth of transactional data at your fingertips. You can use that data to understand how members are using your products and services and what they want from their credit union.

For example, you could use transactional data to identify members who regularly use mobile banking and could benefit from a mobile payment solution. Adding mobile payments to their lineup of existing services would help them better manage their finances and keep them engaged with your credit union.

Once you identify these types of opportunities, you can reach out to these members directly with personalized offers for new products and services that help further their financial goals.

3. Establish a baseline for member engagement

With so much at stake in the banking world, measuring member engagement is one of the most important pieces of information that any credit union can gather. The challenge is being able to measure where members are engaging with your company, where they’re dropping off, and where they’re leaving altogether. By analyzing transactional data from channels such as online banking, ATMs, retail branches and mobile apps, you’ll be able to gauge performance across all of your channels and establish a baseline for engagement initiatives moving forward.

When credit union members meet or exceed that baseline engagement, then you can see positive growth in all areas of member engagement and retention. Also, it helps grow membership by increasing new account openings as referrals.

4. Predict evolving member behavior with data modeling

With the advent of advanced data analytics and predictive modeling in finance and banking, credit unions have access to more information about members than ever before. However, as with most industries, it’s not so much about having access to the data as it is being able to make sense of it. With all this data available, credit unions can use predictive data modeling to get a better idea of where members may be headed and what they’ll want next — and how they can adapt to provide those services in a way that ultimately increases revenue while delivering an outstanding experience.

The use of predictive modeling enables credit unions to look beyond their current member base to reflect back how those members have evolved over time. This helps you to create a portrait of who your current members are; what they’ve done in the past; how they’ve behaved; and how that behavior could evolve in the future.

5. Anticipate member needs

By itself, transactional data can be overwhelming and difficult to use. However, when combined with other data sources, it can provide valuable insights for credit unions.

Transactional data is a powerful insight source that allows credit unions to better understand and anticipate member needs, which ultimately leads to more effective engagement and higher member loyalty.

By understanding transactional data, credit unions can create targeted campaigns that encourage members to:

- Use their debit card more often

- Apply for an auto loan (based on activity at the dealership)

- Sign up for a retirement savings account (based on grocery purchases)

- Open a home equity line of credit (based on home improvement purchases)

To build all these use cases, you need to ask the very fundamental question of how to build a data bank and a data department. And once you cross that bridge, a solid data governance framework for a single source of truth.

6. Make targeted marketing

Credit unions have historically used segmentation to manage their marketing and sales efforts. But today’s approach to segmentation is underwhelming.

Traditional credit union segmentation is based on demographics, product usage and lifetime value. You should still use demographic information, but if that’s all you have to go on, you’re leaving a lot of potential upside on the table.

In order to stop leaving potential upside on the table, credit unions need to start using transactional data in their segmentation strategies.

Transactional data can help you pinpoint specific behaviors for each of your members. The more granular the data, the greater the potential insight you can gain into your members’ behavior.

Here are four ways you can use transactional data to develop targeted marketing campaigns that reach specific segments:

- Using a member’s transaction history to determine what products or services they need

- Determining when members should be contacted about a product or service

- Identifying new triggers for offers (i.e., when a member makes a large deposit)

- Notify members that they have high-interest debt

7. Reduce risk and fraud

Credit unions are always looking for more efficient ways to reduce risk and fraud in their organizations. In the past, many institutions have relied on consumers’ credit scores, which may seem obvious but also has its downsides.

The problem with using credit scores as a measure of risk is that it takes into account all types of consumer spending, not just relevant spending categories or types. Many consumers who have healthy financial habits may still have poor credit due to factors outside their control, such as medical bills or even student loans.

The better metric for measuring risk is transactional data, which shows how much money a person spends each month (and on what) and how often the individual pays his or her bills on time. Most importantly, transactional data allows credit unions to help reduce risk and fraud.

Zuci’s Credit Underwriting Solution – HALO helps credit unions reduce credit risk and minimize the overall credit cost by improving the quality of loan disbursals. HALO can also enhance the underwriting processd efficiency byd reducing the time lost on bad clients, thus increasing thed number ofd right approvals.

8. Optimize overall spending

One of the most important uses of transactional data is to optimize — or reduce overall operating cost. Credit unions can gain a better understanding of where their hard-earned money is going and how they can create more savings by using transactional data.

For example, analytics may show that members are using non-network ATMs more than ever before, which is a red flag for credit union executives. However, data analysis can also reveal that this may be user error — members may not know there’s a network ATM nearby where they could save on fees. In this case, credit unions can use the insights from the transactional data to implement GPS or mobile locators to help members find the nearest ATM in the network.

Here are some examples to optimize or reduce overall operating cost using transactional data:

- Identify members who have been inactive for a long time and provide them with incentives to continue their banking relationship with your credit union.

- Identify members with low average loan balances and provide them with incentives to take out larger loans in the future.

- Identify members who have a zero balance or very low balance on their checking accounts and incentivize them to increase the balance (this improves your net interest margin).

How your credit union can get started with a data strategy?

Credit unions lag behind other financial institutions when it comes to the use of data analytics. For instance, a recent report from the Credit Union National Association stated that only a tiny percentage of credit unions currently use advanced analytics, compared to banks.

Credit unions have been slower to adopt advanced analytics for several reasons. First, credit unions often struggle with data integration and management. Second, credit union executives tend to be more conservative than their banking counterparts and are less likely to embrace big changes in technology at an enterprise level. Finally, some credit unions lack the talent needed to drive growth through analytics and data science initiatives.

For these same reasons (particularly the first two), credit unions also lag behind in their adoption of data-driven marketing techniques. And this is a loss because it’s a missed opportunity for growth that can be addressed relatively quickly by leveraging existing customer data assets.

In fact, several credit union marketing leaders have already successfully implemented micro-segmentation and triggered messaging programs that leverage member transaction data to drive increased engagement and loyalty among members as well as new account acquisition efforts.

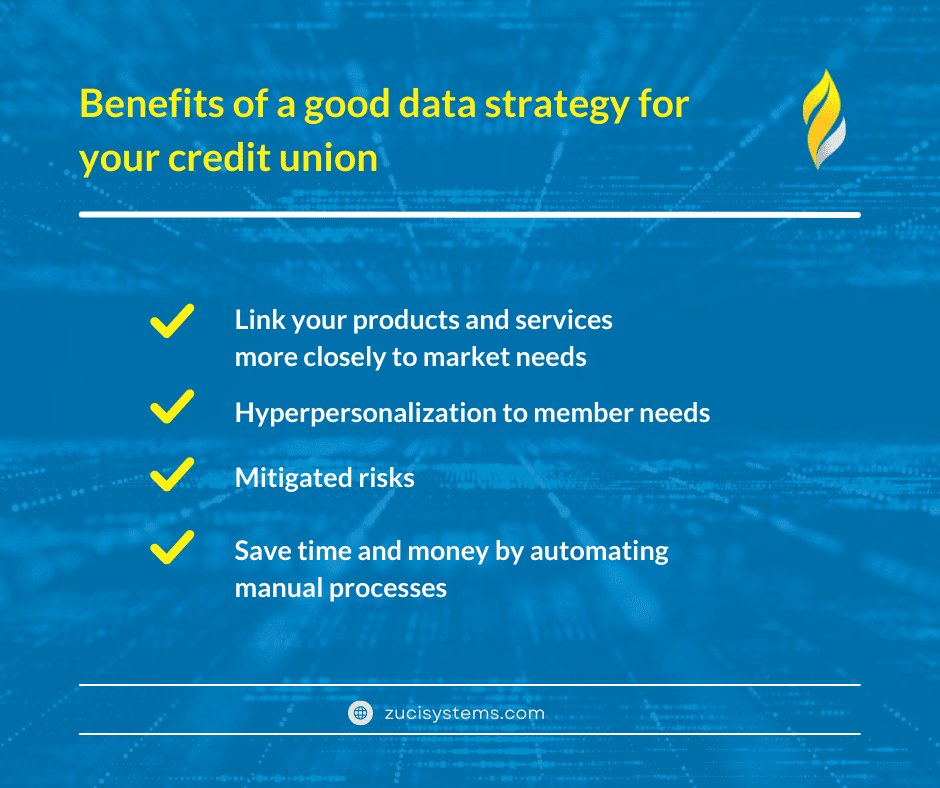

Benefits of a good data strategy for your credit union

Credit unions face many challenges. They must satisfy the needs of members, provide quality customer service, and maintain profitability. In order to achieve these goals, credit unions must adopt new technologies and transform the way they operate.

With a good data strategy in place, your credit union can focus on what’s important: serving members.

A good credit union data strategy will allow you to:

- Link your products and services more closely to market trends and member needs.

- Increase solution adoption and personalize engagement by tailoring promotions to specific member profiles.

- Mitigate risks by discovering patterns that could lead to fraud or errors in spending projections.

- Save time and money by automating many of the manual processes for tabulating data.

Final Thoughts

There is an old saying, “you don’t know what you don’t know.” This certainly holds true for credit unions that are not using transactional data in their growth strategy.

It is a safe bet that the majority of credit unions are not using transactional data because it is expensive and difficult to access. But with the right technology and partners, this information can yield amazing results.

With credit unions across the country thriving and surviving in the face of increasingly intense competition from banks, it’s clear that transactional data strategies are critical for growth.

If you’re seeking a competitive advantage from your data, schedule a 30-minute call with our data engineers to identify and fix your data problems and become a data-driven banking institution. Sign-up and get your customized roadmap for Free.

Related Posts

Related Posts