Reading Time : 2 Mins

How to identify RPA use cases for your credit union?

I write about fintech, data, and everything around it

A blog on identifying use cases of RPA within the banking and credit union industry. At the end of this blog, you will be armed with a complete RPA use case buffet, ready to be prioritized and acted upon.

RPA is a very powerful technology, and when used correctly, it can be a game changer. However, to maximize the level of impact from RPA on your credit union, it is critical to ensure that you have eliminated as many non-RPA related risks as possible with your current operations.

At the end of this blog, you will find an RPA use case buffet for your credit union so that you can effectively prioritize and choose which are most valuable for the team’s immediate needs and those that could have long-term benefits for the entire organization.

Let’s get started.

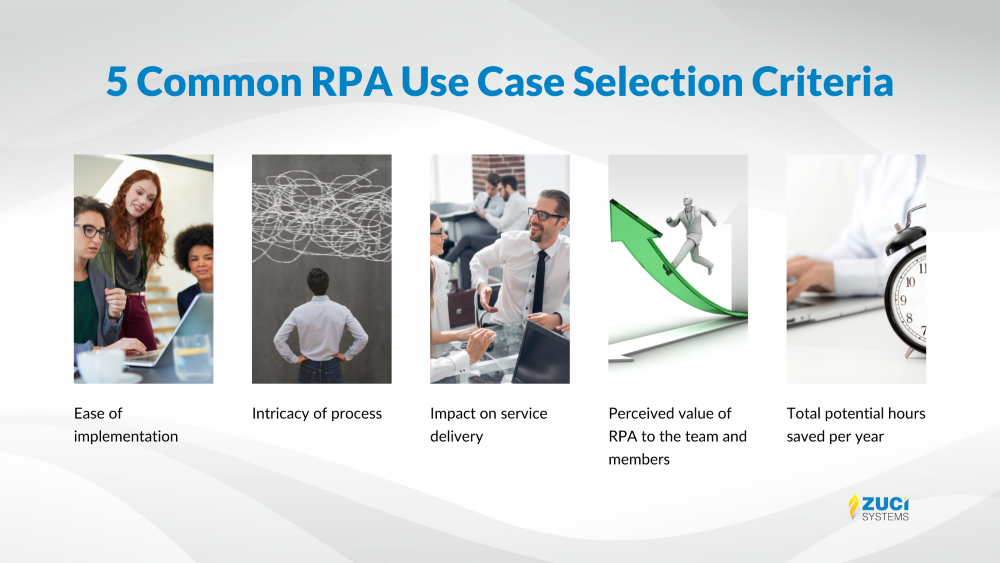

5 RPA Use Case Selection Criteria to Consider for Credit Unions

Robotic Process Automation is a rapidly emerging technology that promises to deliver real-time benefits to businesses and consumers alike. However, RPA use cases are still evolving and changing as the technology evolves.

As a result, it can be difficult for credit unions to determine which RPA use cases are best for their business or organization.

In order to successfully embark on the journey to implement RPA, you need to have a clear vision of how it will help your credit union.

But before you move forward with any RPA initiatives, consider these 5 common RPA use case selection criteria:

1. Ease of implementation

A credit union that can easily implement RPA into their business will be able to gain an advantage over other organizations that are using the technology without complete understanding. When it comes to implementing RPA, it is important that you consider how easy it will be for your organization to get started with the technology. The easier it is for you to begin using RPA, the sooner you will start seeing results and saving money in the process.

But there are many factors that could make the RPA adoption difficult, and this will affect the success rate of your project. Some examples include:

Cost: If you want to use RPA for your credit union, you need to find out if it is affordable for you or not. You may require additional software licenses or training resources, which may cost more than what you expect.

Difficulty: Your project’s success rate depends on how easy it will be for your employees to learn new skills and develop cutting-edge technology. You should also consider how difficult it will be for them to work with different systems and platforms, especially if they have never used RPA before.

Experienced workforce: Another important factor you should consider when choosing RPA use cases is whether or not your employees are experienced enough in working with technology and automation solutions. Mainly, your technology people must have enough experience working with artificial intelligence (AI) and machine learning (ML) to implement RPA for complex use cases like credit underwriting automation, signature verification, fraud predictions, and AML.

2. Intricacy of process

Business processes are more likely to be complicated than simple transactions.

For example, suppose you are looking at moving money from one account to another. In that case, multiple steps will likely be involved (such as creating a wire request and entering details into a transaction application). If so, your RPA solution will need to be able to handle all of these tasks by itself. If your RPA solution can only take one or two tasks, it will not be able to complete all aspects of the process independently.

Credit unions should consider the following criteria when selecting RPA use cases:

Financial transactions: The more complex the business processes, the higher the use case value. For example, a credit union’s loan application process may involve multiple steps with many different users. It is important to evaluate how RPA can improve efficiency and reduce errors by automating manual processes that use extensive information.

User-facing applications: If a credit union has high-volume user-facing applications that require sensitive data, such as member information, it may be worth automating them rather than relying on manual data entry.

Transactional applications: Transactional applications include tasks such as account reconciliation and payment processing that humans typically perform. These tasks are not always well suited for automation because they involve complex business logic or large amounts of data entry. In addition, transactional tasks often require a human touch to ensure that they are completed correctly and promptly.

Non-transactional applications: Non-transactional applications include internal administrative tasks such as updating job titles or approving contributions from employees’ paychecks. These types of activities also require some level of human interaction.

The complexity of each process is an important consideration when choosing your RPA use cases. You will want to select RPA use cases that are simple enough to be automated and complex enough to provide real value.

3. Impact on service delivery

In order to ensure that service delivery is positively maintained, it is important that credit unions pay attention to the RPA use case selection criteria.

For example, if a credit union implements RPA and customer satisfaction is improved, then it is more likely that customers will repay their loans in time and not default. This will positively impact the credit union’s loan portfolio and increase the profit margin of this institution.

RPA use cases should be selected that have the potential to improve customer satisfaction, reduce costs and increase transparency. This is especially important for smaller credit unions that may not have the resources to implement an enterprise-wide RPA solution.

4. Perceived value of RPA to the team and members

In order to determine which use cases are worth pursuing and which are not, a credit union first needs to determine how much value it can get from using RPA. This is done by identifying each use case’s perceived value to the team and members. The best way to do this is by using an expert panel or a survey, but any way you can gather feedback from your employees will work just fine.

Next, you need to decide which use cases are going to be used most often by your members. The more popular the use case among team members, the more they can be used as a selection criterion when identifying RPA use cases for your credit union.

Once you have determined which use cases you want to pursue, it’s time to find out how long it will take for them to be completed annually.

5. Total potential hours saved per year

Credit unions have a lot of data to sift through, but they also have limited time and budget. To ensure they are investing in the right technology, they need to know the return on investment (ROI) that the RPA solution will provide. The total potential hours saved per year is one of the most valuable factors when considering RPA use cases.

If you can show how an RPA solution will save credit unions money by reducing manual work, that’s a big deal for your credit union board members.

Identifying use cases that can save potential hours per year could help your credit union ensure that your employees are working on important tasks.

So, showing your credit union board members how any RPA use case can save money by reducing your team’s workload — or at least making them more efficient — could go a long way towards selecting and winning more business.

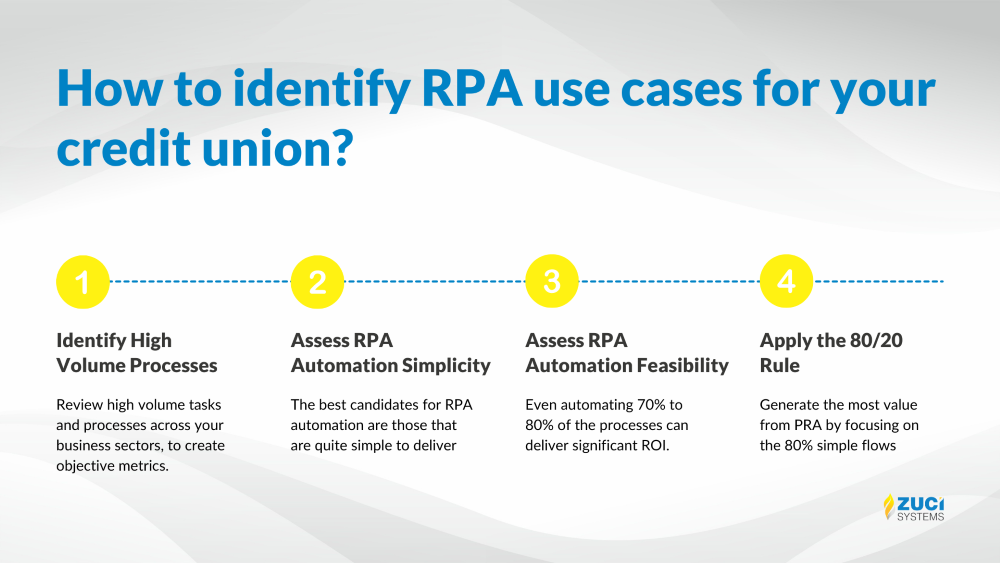

4 Steps in Identifying RPA Use Cases for Credit Unions

Credit unions can use RPA technology to streamline operations, improve customer service and increase productivity. But they must first understand what tasks they want the software to perform to determine whether RPA is right for them.

Here are four steps credit unions should take when identifying RPA use cases:

1. Identify High Volume Processes

High volume processes are those that are critical to the success of a credit union and require staff to complete tasks in real-time. These processes include loan processing, fraud management, and account servicing. Identify high-volume processes by reviewing existing data on all transactions within these areas.

If a credit union has high-volume processes, it will be more efficient and effective if they are broken down into smaller units. Breaking down the overall strategy into smaller units will enable you to understand the process more clearly and identify potential improvements.

Here is how you can identify the high-volume processes performed by your credit union employees:

a) Start at the macro level, understand the overall strategy and business unit objectives

Start at the macro level, and understand the overall strategy and business unit objectives. Then break down each process into its individual components that are performed by various employees or teams within your credit union.

Once you have identified these processes, evaluate them for effectiveness. For example, if your credit union has an hourly processing team that performs a large amount of work in an hour, it may be better for them to move their work to another department or employee who can complete it more quickly.

b) Meet with the business unit leaders to understand their goals and challenges

Meet with your credit union business unit leaders who will be responsible for implementing the RPA solution. The goal of this meeting is to understand their goals, challenges, and objectives for using RPA solutions. This will help you determine which RPA solutions may be useful for your credit union.

c) Meet with front-line staff to understand their daily challenges

Meet with front-line staff who work in these critical functions to understand what they do on a daily basis and how they currently process payments or other transactions.

Ask them questions such as:

- What do you like most about your job?

- What do you like least about your job?

- Why do you like/dislike working at this bank or institution?

With all this information you would have collected now, it’s time to expand the view to enterprise-scale and identify use cases across business units.

2. Assess RPA Automation Simplicity

Once you are done identifying high-volume processes for your credit union, your next step is to assess the ease of implementing RPA automation in this process. This can be done by looking at the number of steps required to complete a task, their complexity, and the amount of human intervention required.

For example, if two steps are involved in completing a task, one that requires no human intervention and another that does, it would be easier to automate the task with fewer steps. Likewise, suppose there is just one step that requires human intervention, and machines can complete all others with minimal human effort or skill. In that case, you should consider automating that process as well.

3. Assess RPA Automation Feasibility

It’s important to consider how RPA can be implemented. You may need to assess whether the use case would be feasible in your credit union, including determining if a suitable training program exists. You’ll also need to determine if the technology is available and whether it’s cost-effective.

Before you can start planning your RPA implementation, you need to assess the feasibility of your automation project. This includes considering the following factors:

- RPA adoption velocity — How quickly will credit unions adopt new technology?

- RPA maturity level — How well-established is your company’s RPA team?

- Business requirements — What are your business requirements for implementing RPA?

- Costs and benefits — What are the costs of deploying RPA solutions compared to the benefits?

4. Select, Prioritize and Implement the Use Cases by Appling the 80/20 Rule

The final step in the RPA process is implementing the use cases by applying the 80/20 rule. The 80/20 rule states that 80% of your effort should be focused on 20% of your overall business outcomes. The other 20% can be allocated to new opportunities or use cases.

The 80/20 rule helps you identify which use cases are critical for your credit union and which ones you can move on to other teams if necessary.

For example, if a process takes three days to complete but yields $1 million in savings per year, it may be worth investing in improving it rather than investing in one that yields $10,000 in savings but takes four days to implement.

Finally, once the credit union has prioritized its list of RPA use cases based on their impact on financial results and their time and cost requirements, it’s time to identify how many full-time equivalent (FTE) employees would be needed to execute each one — and how much it would cost — based on how long and complex each situation is assumed to be.

Takeaway

As a Credit Union Embarking on your RPA journey, understanding your business’s various RPA use cases is the first and most critical step toward ensuring a successful RPA implementation journey for your credit union.

We believe that achieving true benefits from RPA requires a thorough understanding of all aspects of an organization. This includes strategic goals, core processes, automation maturity, and the technological ecosystem. Applying this knowledge will empower you to approach RPA strategically as a means to advance business value.

Again, this is not a comprehensive list. There are numerous other ways to select and prioritize use cases for RPA automation, but it is important to maintain balance in this process. Be sure to identify use cases that can be accomplished using low-cost, readily available software and solutions. Remember that even if you don’t choose an implementable solution now, these use case ideas will help shape your future decision-making. The most important thing is to get started.

At Zuci Systems, we have worked on use cases ranging from lending & mortgage, risk & compliance, customer service, report automation, employee on-boarding, service desk automation, and more. With a gamut of experience, we have established a highly structured approach to building and deploying Credit Union RPA services and solutions. We work hand in hand with you to define an RPA roadmap, select the right tools, create a time–boxed PoC, perform governance, set up the team, and test the solution before going live.

Related Posts