Reading Time : 1 Mins

Data-Driven Banking: How Is Data Changing The Banking Landscape?

This blog post will briefly introduce how banks and financial institutions can transform customer centricity into a competitive advantage through data-driven banking. What are the different data-driven banking use cases? And lastly, how to get started.

With the increasing significance of data in every industry of our lives, banking is no exception.Your data isessentialand plays a significant role in your day-to-day banking activities.

Financial services institutions are finding new ways to leverage data and predictive analytics to enhance the customer experience and assets for business growth.

Moreover, banks are now looking for more than just incremental gains. They want revenue breakthroughs by identifying hidden opportunitieswiththeir data that will directly impact their bottomline. Don’tyou feel you shouldalsobe making the most ofyour data?

If yes?Have you ever wonderedwhatisthe importance of data in banks and financial institutions?How does data help financial institutions to provide data-driven banking?Whatarethedata-driven use cases for banks and financial institutions?Well,fret not.This blog postuncovers allthis invery simplelanguage—nofiller orfluff.

In this blog post, you will get an overview on:

- How is data changing the banking landscape?

- The importance of data in banking

- What is data-driven banking?

- Data-driven banking use cases

- Data-driven Banking: How to get started?

Let’s get started.

Howis data changing the banking landscape?

For a second, imagine. When you step into a bank to take out money, the scenario is set.

Smiling cashiers with loose morals, a queue that accommodates all human shapes and sizes, people minding their own business.

But things have changed todayto averylarge extent.You know what the change element is.No pun intended. But Covid has seriously been a major change element in transforming the banking landscape.

Just imagine: every emotionless person who works behind a desk at a bankisreplaced by software running on amobile or desktop. The entirebankingprocessiscompleted online without even stepping out of your home! If you ask me,”How is data changing the banking landscape?”It’s turning it upside down!

It is safe to say that data has and will continue to change the banking landscape.How, you ask?

Well, data is changing banking ina number ofways,including:changing how banks think about risk; changing how banks interact with their customers; and changing how banks understand and identify newgrowth opportunities. Andthat’s not all.

Butwhat is the importance of data in banking?How to unify all data and overcome silos across systems?Andis itimportantto havea data strategy in place?If these are some questions popping up in your mind. Then,keep reading.

The importance of data in banking

Data is quickly becoming a cornerstone of how banks operate. It’s the communication tool of the future — and it has great potential to help banks solve some of their biggest problems.

Today’s financial marketplace has become a data-driven world. Data enables financial services providers to offer personalizedservice, improve efficiency and ultimately increase profitability. This shift has profound effects on every aspect of banking: operational costs, staffing strategies, customer experience,and more.

Thefuture of banking will lookverydifferent from today’s banking, and it will relycompletelyon data collected by machines to help offer customers more personalized experiences.

Future leaders will build their brands on a foundation of data — an intelligent foundation that understands people at all stages of their financial journey.

While many banks and financial institutions have already laid the foundation for the future, very few are fully aware of what organizations should consider when building a data analytics roadmap or strategy.

Read the full blog from our CEO on “ How to build a data analytics strategy?”This blog willhelp you get started with a strong foundational strategy forthefuture of banking.

That said, it is understood that data allows banks to create personalized experiences for customers through personalized CRM systems and self-service options on websites.Buthow does data help in doing that? Andwhat is data-driven banking?

Let’s find out.

What is data-driven banking?

Data-driven banking is a way of looking at your banking data in a new way. Rather than showing you a set of information about your account, showing you thecurrency movements,or handing over your data for analysis, banksuseit to put more information about products and services into their products and services.

In simple terms, data-driven banking is about using data and analytics to better serve customers.

It’s about using technology and analytical processes to aid in strategic planning and decision-making. Not only does this give banks more insight into their customers’lives, but it gives them an edge in terms of increasing their profits — by providing them with more accurate data about their clients or customers’ needs.

This can help you make better decisions, but it also has valuable social benefits – allowing people to find out about a bank’s products through third-party companies.

Data-driven banking use cases

Data-driven banking is fundamentally changing the way companies interact with their customers. Data enables companies to answer questions that would previously have taken analysts years to answer. This has resulted in increased efficiency and reduced costs acrossseveralfinancial services institutions.

Financial services companies that are embracing this change are seeing the benefits it brings to their bottom line.

Let’stake a lookatfewuse cases that illustrate the way banks are using big data to transform the way they serve their customers.

Data-driven banking use case #1: Better Customer Experience

There’s a natural progression in the use of data in banking. There was a time when customers had simple bank accounts with only a few basic features. As their needs and finances evolved, so did the banking experience. Today, most customers have multiple financial accounts with wide-ranging features – and better access to data via apps, mobile devices,and the internet.

Also, along with customer-facing apps, operational departments alike have benefitedsignificantlyfrom automated data collection and analysis.

That said, as companies move to data-driven solutions, traditional bank revenue will likely decline as customers shift to more personal or‘digital’ banking solutions.

Data-driven banking use case #2: Automated Credit Approval

Automated credit approvalis a revolutionary new way of managing customer accounts. Approval is provided by a machine learning model trained on the customer’s data, including their payment history, purchases,and exposures, that is tailored to their individual risk profile. Approval can be given with a simple click ofabutton, resulting in faster and more efficient account service.

Thisopens upnew possibilities for customers as it also enables them to obtain finance on applications that are previously discounted or only available on weekends and bank holidays.

Faster access to finance for less qualified customers, combined with the opportunity to build good habits by getting access to finance ataslightly reduced cost, willopen upnew opportunities for families and individuals to both reduce indebtedness and improve financial stability.

Watch our webinar to learn how banks and financial services can leverage data in transforming the banking landscape for the future. You will hear from Padmanaban T A, Head of Digital Banking at City Union Bank, on how to strategize a secure enterprise data management structure.

Data-driven banking use case #3: Better Risk Management

Banks need to be more proactive in managing risk, and that starts by collecting and using as much data as possible. The benefits are clear: better risk management, lower costs,and enhanced customer experience.

The use of data to drive decisions in key areas such as risk management is creating a revolution in how banks operate. This trend towards smarter risk management is centered on two approaches: collecting more data and using that information to provide more relevant and actionable information.

Combining these approaches is creating an environment where banks can take a more strategic approach to risk management,taking into accounthow their activities impact customers, business,and the economy at large.

Data-driven banking use case #4: Capital Reconstruction

The fourth transformative use case for big data,whichwill have the biggest impact on the banking industry, is the reconstruction of capital. Reconstruction means identifying where the capital shortfallexists within a company and then using data-driven analytics to target alternative investment opportunities and close the gap.

Once identified, regenerative investment can be implemented rapidly, leading to cost savings and increased shareholder value within just a few weeks.

As more consumers turn to technology to solve their financial challenges, traditional financial institutions will need to remain nimble and responsive if they want a chance at competing in a rapidly changing marketplace.

Data-driven banking use case #5: Faster Fraud Detection

Fraud detection is one of the most challenging aspects of applying data-driven analytics to everyday banking.

Faster fraud detection can isolate and mitigate future losses from insider attacks, cyber-attacks, fraud by illicit actors,and other activities that try to misuse data or take advantage of unsophisticated consumers. Faster fraud detection means preventing costly and time-consuming investigations that can take months or years to complete due to the persistence of small acts of wrongdoing by employees or clients that slip through the net.

Accelerating fraud detection through data allows bank operators to better respond to their customers’evolving risk behavior while also reducing operational costs and compliance risks.

Data-driven banking use case #6:Productive Sales and Marketing Engines

Data-driven marketing and sales are shaping up to be the next big thing in banking. With more data available to banks on their customers, they’ll be able to make more informed decisions about marketing campaigns and sales channels.

It’s an exciting time for marketers and users alike, as banks begin to understand how combining data can help improve campaigns and increase profits.

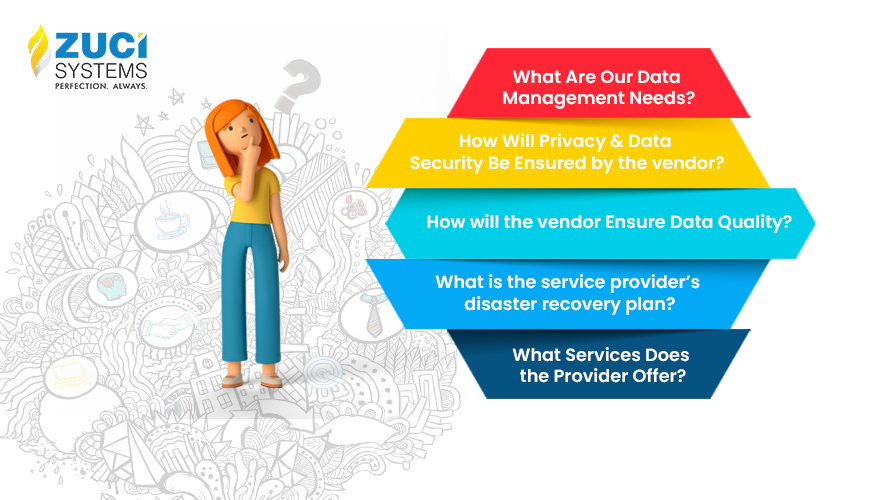

Data-driven Banking: How to get started?

Banking has changed.Today, your customers choose how they want to bank – online, mobile,or through social platforms. With so many choices available, how do you decide which data-driven option is best for you?

Well, we have a way aroundit. Follow these8steps to get started.

- Start with a business use case and identify clean data

- Define clear KPIs

- Find the data sources

- Model the data

- Integrate your models into a data dashboard

- Continuously building data pipeline infrastructure before and after modeling

- Adhering to MLOps principles and best practices

- Set up engineering practices for data sciences (E.g., Exposing APIs for meaningful consumption)

We started off with the business problem and picked our spots on where we would want to focus. Considering the pandemic, we wanted to safeguard our balance sheet, and on the other side, we still wanted to grow. So we chose jewel loans and overdraft cash credit as our focus area and took Zuci’s help to identify data sources and build a model which helped us predict the loan portfolios with 99.5% accuracy.

With the right foresight, banks and financial institutions can be the core of data-centric systems and be one of the major drivers for cultural change.

Final Thoughts

Banks are still looking for ways to make better decisions using datain order tooffer more personalized services. As more data in the financial industry is exposed, banks seem to be shifting to self-service technologies that directly impact consumers.

Ifyou want to start your Data-Driven Bankinginitiative?Orthinkingabout personalizing your customer banking experience?Well, here atZuci, we’re fascinated by the idea of creating an engaging banking experience that helps our banking partners succeed.

Our mission is to use cutting-edge technology and analytics for customer benefit: providing better service, growing their business,and making smarter decisions.

So, whether you are an SME or enterprise company, data tracking is the key to the success of your business. Schedule a 30-minute call and learn about Zuci’sData Engineering Services to craft a single source of truth system for real-time data analytics, business reporting, optimization, and analysis.

I write about fintech, data, and everything around it | Assistant Marketing Manager @ Zuci Systems.

Share This Blog, Choose Your Platform!

Related Posts

Related Posts